Thinking about getting a home loan but overwhelmed by the sheer number of options available? You’re not alone and this is exactly why mortgage brokers, like us, exist.

A mortgage broker is a licensed financial professional who acts as a middleman between you and multiple lenders, helping you navigate the complex world of home loans and finding a product that genuinely suits your situation.

Instead of going to just one bank and accepting whatever they offer, a broker compares options across dozens of lenders, negotiates on your behalf, and handles most of the paperwork.

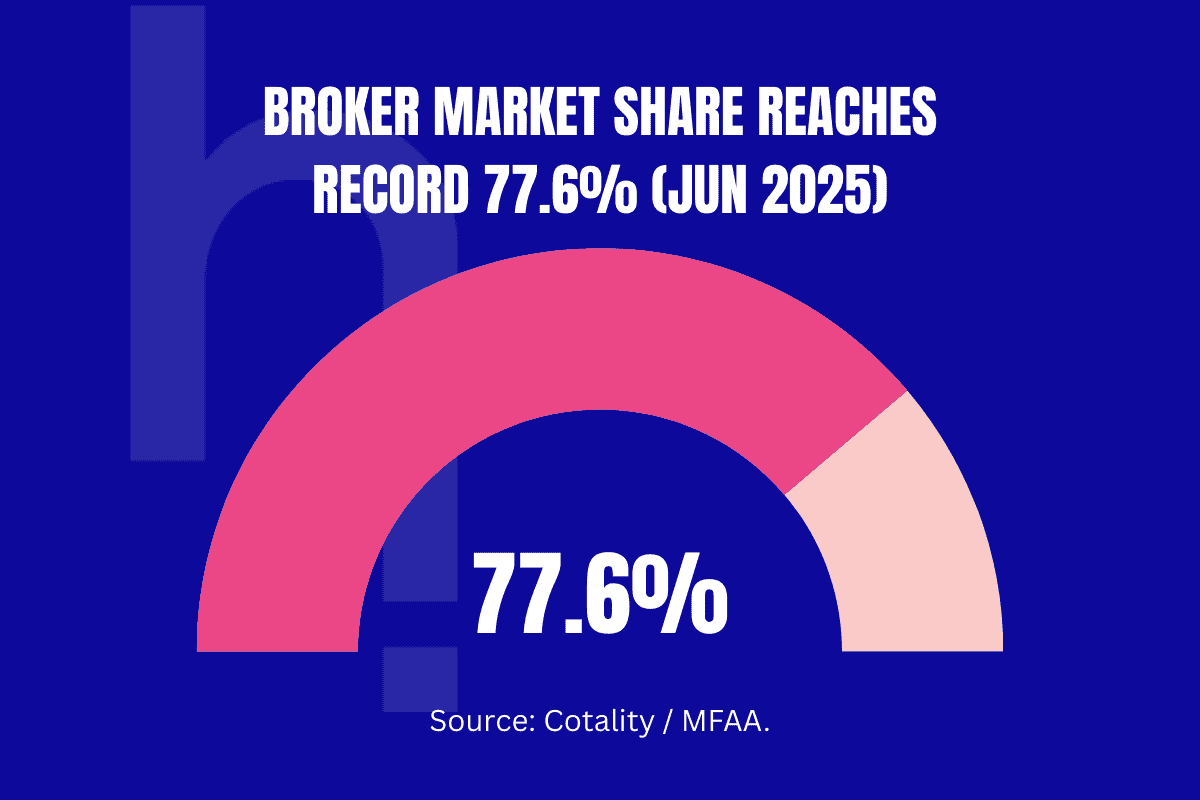

For the majority of Australian homebuyers, working with a mortgage broker has become the standard approach. In fact, brokers now arrange 75% of all new residential mortgages in Australia.

If you’re considering using a broker or simply want to understand how they work, this guide covers everything you need to know. Our brokers are ready to discuss anything you need, should you have any questions.

What is a Mortgage Broker?

A mortgage broker is fundamentally different from a bank loan officer, and understanding this distinction is crucial. While a bank representative can only offer you the products their bank provides, a mortgage broker is an intermediary who works with a panel of multiple lenders, typically ranging from 30 to 70+ different lenders depending on the broker. And guess what, we have access to over 80! This includes major banks, regional banks, credit unions, mutuals, and specialist non-bank lenders.

The key difference is who the broker works for. Banks work for themselves and their shareholders. Mortgage brokers, on the other hand, are legally bound by a statutory obligation called the Best Interests Duty (BID), which came into effect on January 1, 2021. This legal requirement means brokers must act in your best interests when recommending home loans, not in the interests of lenders who pay them commissions. This represents a fundamental shift in the industry and is one reason why brokers have become increasingly popular. Consumers can trust that recommendations are genuinely designed to help them, not maximise the broker’s commission. For example, brokers aren’t allowed to push a loan that is paying the highest commission. They need to understand what YOU want and need based on your current position and goals.

Brokers are licensed financial professionals who typically hold at minimum a Certificate IV in Finance and Mortgage Broking, and most work toward or maintain a Diploma in Finance and Mortgage Broking Management. They’re regulated by the Australian Securities and Investments Commission (ASIC), must comply with the National Consumer Credit Protection Act, and are required to be members of a dispute resolution authority like the Australian Financial Complaints Authority (AFCA). This regulatory framework protects consumers and ensures brokers operate ethically and professionally.

What do Mortgage Brokers actually do?

The work of a mortgage broker extends far beyond simply comparing interest rates. Here’s what typically happens when you work with a broker from start to finish.

Understanding your financial situation

The process begins with a comprehensive assessment. Your broker will sit down with you (either in person, by phone, or via video call) and discuss your financial situation in detail. This includes your income from all sources (employment, Centrelink, child support, rental income, business income, investments) your current debts and liabilities, your savings history, your credit profile, and most importantly, your financial goals. Are you a first-home buyer? An investor looking to add another property? Someone wanting to refinance to a better rate? Are you self-employed with complex tax structures? All of this information shapes the recommendations the broker will make.

During this stage, a good broker will calculate your genuine borrowing capacity. Not just what you can technically qualify for, but what you can realistically afford without stretching yourself too thin. Many brokers use sophisticated tools to stress-test your budget against interest rate rises and unexpected expenses, ensuring they’re recommending a loan you can manage long-term.

Researching the lending market

Once your broker understands your situation, they spend time researching the lending market to identify which lenders are most likely to approve your application and which products suit you best. This is where the broker’s deep knowledge of the market becomes invaluable. They understand the lending policies and preferences of different lenders, which lenders are more accommodating to specific situations (like self-employed borrowers or those with previous credit issues), and which products offer the features you need.

A broker might know, for example, that one bank is currently offering competitive rates for investors but has strict serviceability requirements, while another non-bank lender is more flexible on serviceability but charges slightly higher rates. They understand which lenders accept Centrelink income readily, which ones require additional documentation for child support, and which specialise in complex income situations. This market knowledge would take you weeks or months to develop on your own.

Comparing options and making recommendations

Rather than applying to multiple banks yourself, which damages your credit score with multiple “hard enquiries”, your broker submits strategic applications to lenders they’ve pre-assessed as suitable for your situation. The broker then compares the offers received, looking beyond just the interest rate to consider the entire package: loan features, flexibility, fees, the ability to make extra repayments, offset accounts, redraw facilities, and other factors that matter to your situation.

A quality broker doesn’t just present you with one option. They typically provide at least three different loan options with clear explanations of the pros and cons of each. They explain the differences between fixed and variable rates, break down what all the fees actually cost you over the life of the loan, and help you understand concepts like loan-to-value ratios (LVR) and how different deposit amounts affect your options.

Handling all the paperwork and administration

One of the biggest hassles of getting a home loan is the documentation. Your broker collects all the paperwork you need (payslips, tax returns, bank statements, proof of assets, identification, proof of single parent status, custody documents, whatever is relevant to your situation) and organises it for lender submission. They verify your financial statements, review your credit history, and ensure everything is accurate before submitting to the lender.

During the application process, brokers act as the liaison between you and the lender. If the lender needs additional information, the broker requests it from you, provides explanations, and submits it back to the lender. This back-and-forth can be extensive, but your broker handles it, saving you the stress of direct communication with credit officers who may use jargon you don’t understand.

Coordinating with other professionals

When you’re buying a property, multiple professionals get involved, valuers, solicitors or conveyancers, building inspectors, and real estate agents. A good mortgage broker coordinates with all these parties to ensure the process runs smoothly. They liaise with valuers to arrange property valuations, work with your solicitor on settlement matters, and keep everyone informed about the application progress. This coordination prevents delays and ensures nothing falls through the cracks.

Negotiating better rates and terms

Experienced brokers have genuine negotiating power with lenders. Because they consistently refer clients to lenders, they have relationships and leverage. They can sometimes negotiate better interest rates than the standard offerings, access promotional rates not advertised to the public, negotiate fee waivers, or arrange other concessions. They might convince a lender to waive application fees, reduce valuation costs, or adjust the interest rate by 0.1-0.2% based on the loan size or the broker’s history with that lender.

This negotiating ability is one of the most valuable services brokers provide. According to research, brokers achieve average interest rate reductions of around 0.35% where they successfully negotiate for clients, which on a $500,000 loan means saving approximately $1,750 per year in interest alone.

Loan structuring and feature selection

Beyond simply finding a loan, good brokers help structure your loan strategically. Should you split your loan between fixed and variable portions? Would an offset account make sense for your situation? Should you consider interest-only for a portion of the loan? These decisions can have significant financial implications, and a broker explains how different structures work and which makes sense for you.

For investors, brokers might structure loans differently than owner-occupiers to maximise tax efficiency. For those trying to avoid Lenders Mortgage Insurance (LMI), brokers help structure the loan to get under the 80% LVR threshold. For those with complex income, brokers might suggest specific structures that help you demonstrate serviceability.

Post-settlement support

Many people think a broker’s job ends when the loan settles, but quality brokers provide ongoing support. This includes annual loan reviews to ensure you’re still on a competitive rate, advice on when rates might change, assistance with refinancing to better products if the market improves, or help restructuring your loan if your circumstances change. Some brokers actively monitor the market and contact clients proactively when better rates become available, potentially saving clients thousands of dollars over the life of their loan.

How do Mortgage Brokers get paid?

Understanding broker compensation is important because it directly addresses potential conflicts of interest. In Australia, brokers are paid in two main ways, and importantly, you, the borrower, generally pay nothing upfront.

Upfront commission

When your home loan settles, the lender pays your broker an upfront commission. This is typically 0.65% to 0.70% of the loan amount, plus GST. So on a $500,000 loan, the broker would receive approximately $3,250 to $3,500 upfront. This is paid by the lender, not by you. It comes out of the bank’s profit margin, not from your borrowed funds.

It’s important to understand that this commission is negotiated between the lender and broker, not set in stone. Experienced brokers with high loan volumes can sometimes negotiate higher rates, while brokers just starting out might receive lower commissions. The amount varies between lenders. Some pay more generous commissions than others, which is why lender relationships matter.

Trailing commission

In addition to upfront commission, brokers typically receive a smaller ongoing commission called a trailing commission, usually around 0.15% of the remaining loan balance per year. So on that same $500,000 loan in year one, the broker receives approximately $750. As you pay down the loan, the trailing commission decreases. On a $480,000 balance in year two, it would be approximately $720, and so on.

The trailing commission incentivises brokers to act in your best interests. If you default on your loan or refinance to a different lender, the broker loses this ongoing income. This financial incentive aligns the broker’s interests with yours: they want you to have a loan you can comfortably afford with a lender that treats you well.

Mortgage Brokers vs. Banks: key differences

The distinction between working with a mortgage broker versus going directly to a bank is significant, and it’s worth understanding the major differences.

| Aspect | Mortgage Broker | Bank |

| Loan Options | Access to 30-70+ lenders with hundreds of loan products | Limited to their own loan products |

| Legal Duty | Legally bound by Best Interests Duty to act in your best interest | No such duty; can act in their own interests |

| Advice Quality | Expertise specifically in mortgages with deep market knowledge | General banking knowledge; limited mortgage expertise |

| Negotiating Power | Can negotiate rates and terms on your behalf | Rates are typically fixed; limited flexibility |

| Application Process | Broker handles paperwork and lender coordination | You manage most of the process |

| Cost to You | Usually free; paid by lenders via commission | No upfront fee, but no negotiating power |

| First Home Buyer Support | 45% of broker customers are first-home buyers vs. 25% overall market | Standard processing; less tailored support |

| Time Commitment | Broker does most of the work; minimal time from you | You do the research and coordination |

| Approval Chances | Higher, as broker matches you to suitable lenders | Depends on how well you fit their criteria |

The data speaks clearly: the latest industry research from 2025 shows that brokers arrange 75% of all new residential mortgages in Australia. This dramatic shift from 67% just four years ago demonstrates that Australian borrowers increasingly recognise the value brokers provide.

When is a Mortgage Broker especially valuable?

While anyone buying or refinancing a home can benefit from a broker, certain situations make a broker particularly valuable.

First-home buyers

If you’ve never navigated the home loan process, a broker’s guidance is invaluable. They explain what first-home buyer schemes you qualify for, help you access government incentives, explain the entire process, and reduce the stress of an already emotional experience. Brokers now work with 45% first-home buyers, compared to only 25% in the overall home loan market, demonstrating that first-time buyers actively seek broker expertise.

Self-employed and complex income

If you’re self-employed, run a business, have trust income, investment income, or multiple income sources, many banks will decline you automatically. Brokers know which lenders specialise in complex income situations and can match you with appropriate options.

Non-standard financial situations

Past credit issues? Divorce or separation affecting your finances? Unusual employment history? Gaps in employment? Brokers know which lenders are more understanding and have worked with similar situations before.

Investors adding properties

Property investors benefit significantly from broker expertise in structuring investment loans, managing multiple mortgages, and optimising for tax efficiency.

Refinancing or loan consolidation

If you have multiple debts or want to refinance existing loans to get a better rate, brokers can restructure your finances strategically.

Recent immigrants

New arrivals to Australia often struggle with traditional banks that don’t recognise overseas income or experience. Brokers have relationships with lenders who are more accommodating to recent arrivals.

Those wanting to avoid lenders mortgage insurance

If you have a smaller deposit, a broker’s expertise in loan structuring might help you avoid the cost of LMI through strategic borrowing and documentation.

The benefits of a Mortgage Broker

Choosing the right Mortgage Broker

Not all brokers are equal, and choosing the right one matters. Here’s what to look for.

Licensing and professional credentials

First and foremost, ensure the broker is licensed. You can verify this through ASIC’s credit licensee or credit representative registers, or by checking if they’re members of professional bodies like the Mortgage & Finance Association of Australia (MFAA) or Finance Brokers Association of Australasia (FBAA). A licensed broker holds at minimum a Certificate IV in Finance and Mortgage Broking and is legally bound by the Best Interests Duty.

Size of their lender panel

Ask how many lenders they have relationships with. Most quality brokers work with 30-70+ lenders. A larger panel generally means more options for you, though even brokers with extensive panels may have preferred relationships with certain lenders.

Independence

Find out about the broker’s ownership structure. Is the broker or brokerage owned or part-owned by a major bank? While brokers are legally required to act in your best interests regardless, independent brokers have fewer potential conflicts of interest.

Experience and specialisation

Do they have experience with your specific situation? First-time buyer? Investor? Self-employed? A broker with relevant experience and a track record in your situation will provide better guidance.

Fee transparency

Understand how they’re compensated. Most brokers are transparent about their commission structure. Be wary of any broker who’s evasive about fees.

Client testimonials and reviews

Check online reviews, ask for references, and see what previous clients say about their experience. Did the broker communicate clearly? Were they responsive? Did they deliver on their promises?

Communication style

Will they take time to explain things in plain language? Do they respond promptly to enquiries? Do they keep you informed throughout the process? A good broker makes the experience straightforward and stress-free.

Common misconceptions about Mortgage Brokers

Let’s clear up some common myths about brokers that prevent people from using them.

“Brokers cost more than going directly to a bank”

False. Brokers don’t charge you upfront fees in almost all cases. They’re paid by lenders via commission. In fact, through their negotiating power, brokers often secure better rates, meaning you actually save money compared to going direct to a bank.

“All brokers are the same”

Not true. Experience, lender access, service quality, and expertise vary significantly between brokers. It’s worth shopping around and meeting with multiple brokers before choosing.

“If I use a broker, I’m locked into one lender”

Completely false. A broker presents you with multiple options, and you choose which lender you prefer. You maintain control throughout the process.

“Brokers only care about getting paid”

The Best Interests Duty legally requires brokers to prioritise your needs. Additionally, brokers lose trailing commissions if you struggle with your loan or refinance away, so they’re financially incentivised to recommend loans you can genuinely afford.

“Banks are safer than brokers”

Neither is inherently “safer.” Both are regulated, but brokers have additional legal protections like the Best Interests Duty that banks don’t. Complaint data shows brokers receive fewer complaints (0.3% of AFCA complaints) than banks.

“I should just apply with my own bank”

While you can, you’ll only see that bank’s products and won’t benefit from comparative shopping or negotiating power. Unless you have a very compelling reason to stay with your current bank, a broker typically gets better results.

The regulatory framework: how brokers are held accountable

Understanding the regulatory oversight of mortgage brokers provides additional assurance about their professionalism and trustworthiness.

Best interests duty (BID)

Introduced on January 1, 2021, following recommendations from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, the Best Interests Duty is a legal requirement that brokers must act in consumers’ best interests when providing credit assistance. This duty means brokers must:

- Assess your needs, goals, and financial situation thoroughly

- Consider your circumstances and the suitability of recommendations

- Recommend products in your best interest, even if another product would generate higher commission

- Avoid conflicts of interest and disclose any that exist

- Keep records demonstrating compliance with these obligations

ASIC provides detailed guidance on how brokers should comply, and the regulator actively monitors adherence to ensure brokers are following the rules.

Licensing and professional bodies

To operate, mortgage brokers must either hold an Australian Credit Licence or be appointed as a Credit Representative under an aggregator’s licence. This licensing process requires brokers to pass “fit and proper person” assessments, including credit checks and police checks, ensuring they’re ethical and trustworthy professionals.

Membership in professional bodies like the MFAA or FBAA is industry standard and typically required by lenders. These bodies maintain codes of conduct and provide ongoing education requirements to their members.

Dispute resolution

If you have a complaint about your broker, you can lodge it with the Australian Financial Complaints Authority (AFCA). Interestingly, despite making up a large portion of the financial services industry, brokers receive very few complaints, just 0.1% of total AFCA complaints relate to mortgage brokers specifically. This data suggests brokers generally operate ethically and provide satisfactory service.

Final thoughts: Should you use a Mortgage Broker?

Given that 75% of Australian homebuyers now use mortgage brokers, the answer for most people is yes. Brokers have fundamentally changed the home loan landscape, making it easier for everyday Australians to access better rates, more options, and professional guidance through a complex process.

However, there are scenarios where you might consider going directly to a bank. If you’re a long-time customer of a bank with an exceptional relationship, have very straightforward financial circumstances, are comfortable with independent research, and are confident you’ll get a good deal, applying directly might work. But for nearly everyone else, especially first-home buyers, self-employed individuals, investors, or anyone with non-standard circumstances, a mortgage broker will save you time, stress, and quite possibly thousands of dollars.

The key is choosing a quality broker: someone licensed, experienced, transparent, and genuinely interested in understanding your situation and providing advice tailored to your needs. Take time to interview multiple brokers, check their credentials, read reviews, and choose someone you feel comfortable working with throughout the process.

Your home loan is one of the biggest financial decisions you’ll ever make. Having a knowledgeable professional in your corner, someone whose success depends on your financial wellbeing, isn’t a luxury, it’s simply smart financial planning.

Are you in the market for a new home but pulling your hair out trying to work out the loan side of things?

Book a call with our expert brokers today.